Overtime when necessary shall be restricted to emergencies or where work is clearly outside the normal daily routine. Reuters pic PETALING JAYA.

Your Step By Step Correct Guide To Calculating Overtime Pay

Basic pay 26 days X 30 X hour of works.

. For example if you are currently at 1000 per hour your overtime pay would be 1500 per hour. As per Employment Act 1955 Malaysia the employee shall be paid at a rate not less than 15 times hisher hourly rate for overtime work in excess of the normal work hours. 60 of Malaysia Employment Act 1955.

Based on the Malaysian Employment Act 1955 overtime hours are limited to 104 hours per month. Salaried and part-time hourly or salaried employees are not covered by the overtime pay policy. The Employment Act provides minimum terms and conditions mostly of monetary value to certain category of workers -.

Ask employees to work more than the maximum amount of hours per day or week permitted by law. I t must first be understood that the entitlement for overtime pay under the Employment Act 1955 is only applicable to employees with wages not exceeding RM2000 a month or those falling within the First Schedule of Employment Act 1955. In the PayrollPanda app you can use the preset overtime item.

How OT hours are calculated based on Seksyen 60 3 Seksyen 60 1 Employment Act 1955. Overtime in the public service is summarised at paragraph 321 of the Human Resource Management Manual. Work on Public Holidays Including weekends put in shall also constitute overtime.

Working on Off-day 20 Basic pay 26 days X 20 X hour of works. For work on a rest day the pay shall be no less than 20 times the hourly rate and on a public holiday no less than 30 times the hourly rate. 86 Overtime 37 87 Time-Off-In-Lieu 38 90 SECTION 2.

The overtime rate is 15 times the hourly rate of pay. Any employee as long as his month wages is less than RM200000 and. IOI will pay overtime work at the legally mandated rate stated herein after 8 hours of work.

If a part-time EA Employee is required by hisher. Any employee employed in manual work including artisan apprentice transport. For staff members whose monthly salary is and any increase of salary where the OT is capped at the Company pays the following overtime rate which is in accordance to the rate provided by the Malaysian Employment Act 1955 as follows-a.

PERFORMANCE MANAGEMENT SYSTEM 38. The High Court in Ipoh today affirmed. 71 Reimbursement of Travelling Claims and Petrol Allowance 15 72 Mobile Phone Allowance 16.

A permit from Department of Labour is required for any overtime above 104 hours per month with conditions of not more than 12 hours of work per day inclusive of. Employers are also prohibited from requiring or permitting an EA Employee to work overtime in excess of a total of 104 hours in any one month. First this policy applies strictly to full-time hourly employees.

It is only offer ed to the workers at the request of the management and whenever there is a need for overtime work. An extract is reproduced below. This comes up to an average of under four daily overtime hours per calendar month so.

For applicable employees any clause in an employment contract that purports to offer less favourable benefits than those set out in the. Additionally its important for employers to note that there is a hard limit to overtime work. Employment law in Malaysia is generally governed by the Employment Act 1955 Employment Act.

The laws in this respect are spelled out in the Employment Act 1955 the EA. Overtime Rate according to Malaysian Employment Act 1955. Set a dailyweekly cap for overtime at 2 hours per day 8 hours per week Employees who work more than that will be compensated according to legal requirements.

Overtime must not be considered as an additional source of income as it remains at all times at the discretion of the Management. 2 Any employer who fails to pay to any of his employees any overtime wages as provided under this Act or any subsidiary legislation made thereunder commits an offence and shall also on conviction be ordered by the court before which he is convicted to pay to the employee concerned the overtime wages due and the amount of overtime wages so ordered by the court. The labour court had awarded the lorry drivers and their assistants RM115000 in overtime rest day and public holiday claims.

321 1 Overtime work shall not be resorted to except where it is absolutely necessary. Ordinary rate pay ORP divide by 8 hours multiply by 15 times. In the case of an employee employed on piece rates who works on a rest day shall be paid 2 times the ordinary rate per piece.

Working on Public Holiday. According to the Employment Limitation of Overtime Work Regulations 1980 employees in Malaysia are only allowed to work overtime for a total of one hundred and four hours in any one month. But we advise employees to respect this limit.

Overtime on normal work days. The Employment Actsets out certain minimum benefits that are afforded to applicable employees. Appraisal 38 92 Performance Interview 39 100 SECTION 3.

For any overtime work carried out in excess of the normal hours of work the employee shall be paid at a rate not less than one and half times his hourly rate of pay. Second overtime is paid at one and one-half of your regularly hourly wage. 2 Where overtime work cannot be avoided a Supervising Officer shall authorize the.

Overtime Work on Rest Day An employee shall be paid at a rate that is not less than 2 times the hourly rate of pay. Overtime on Normal Working Day. The pay for overtime work shall be at a rate of not less than.

Overtime on rest days. CODE OF BUSINESS CONDUCT 40 101 Policy 40 102 Employee Obligation 40 103 Integrity of Business. Normal working day 15 Basic pay 26 days X 15 X hour of works.

The Employment Act 1955 is the main legislation on labour matters in Malaysia.

Your Step By Step Correct Guide To Calculating Overtime Pay

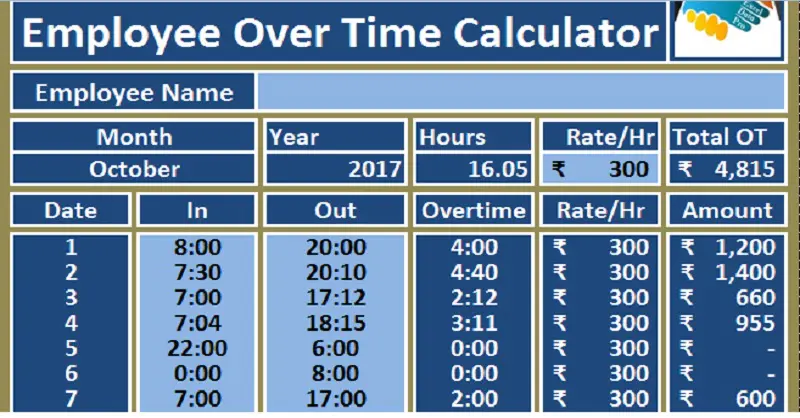

Download Employee Overtime Calculator Excel Template Exceldatapro

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Overtime Statutory Requirements In Malaysia Lexology

How Secure Will Be Your Personal Information After Gdpr Regulations Data Security Payroll Software Cyber Security

Your Step By Step Correct Guide To Calculating Overtime Pay

Download Employee Overtime Calculator Excel Template Exceldatapro

Customizable Employee S Timesheet System In 2022 Time Management Skills Time Tracker Time Management

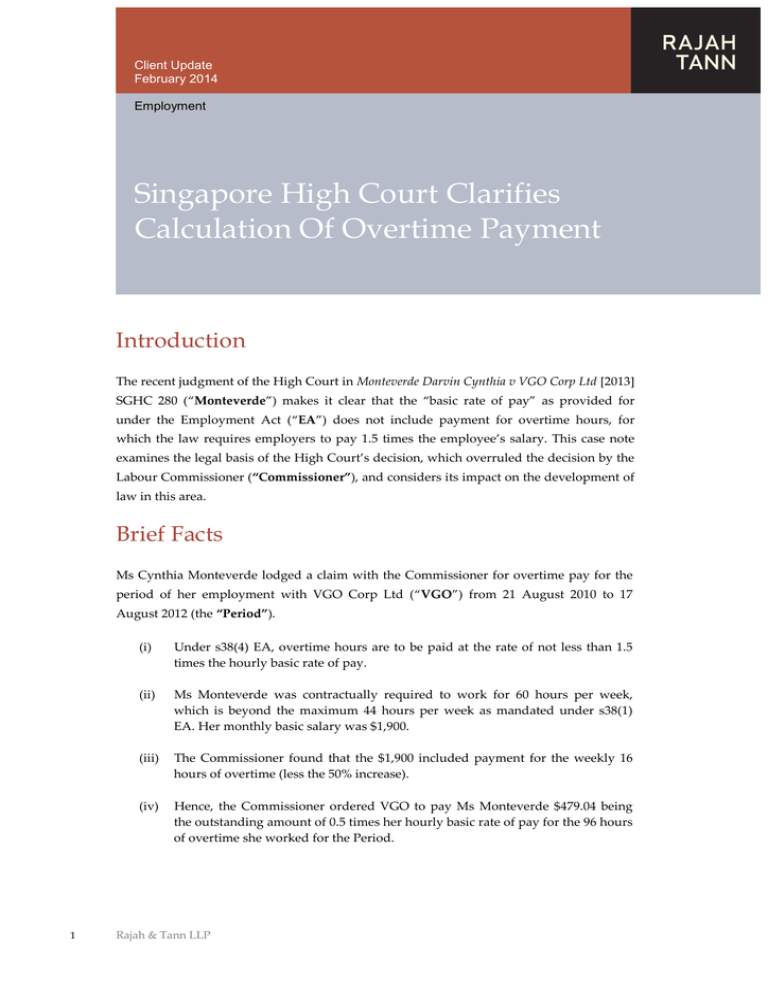

Singapore High Court Clarifies Calculation Of Overtime

![]()

12 Overtime Authorization Forms Templates Pdf Doc Free Premium Templates

Your Step By Step Correct Guide To Calculating Overtime Pay

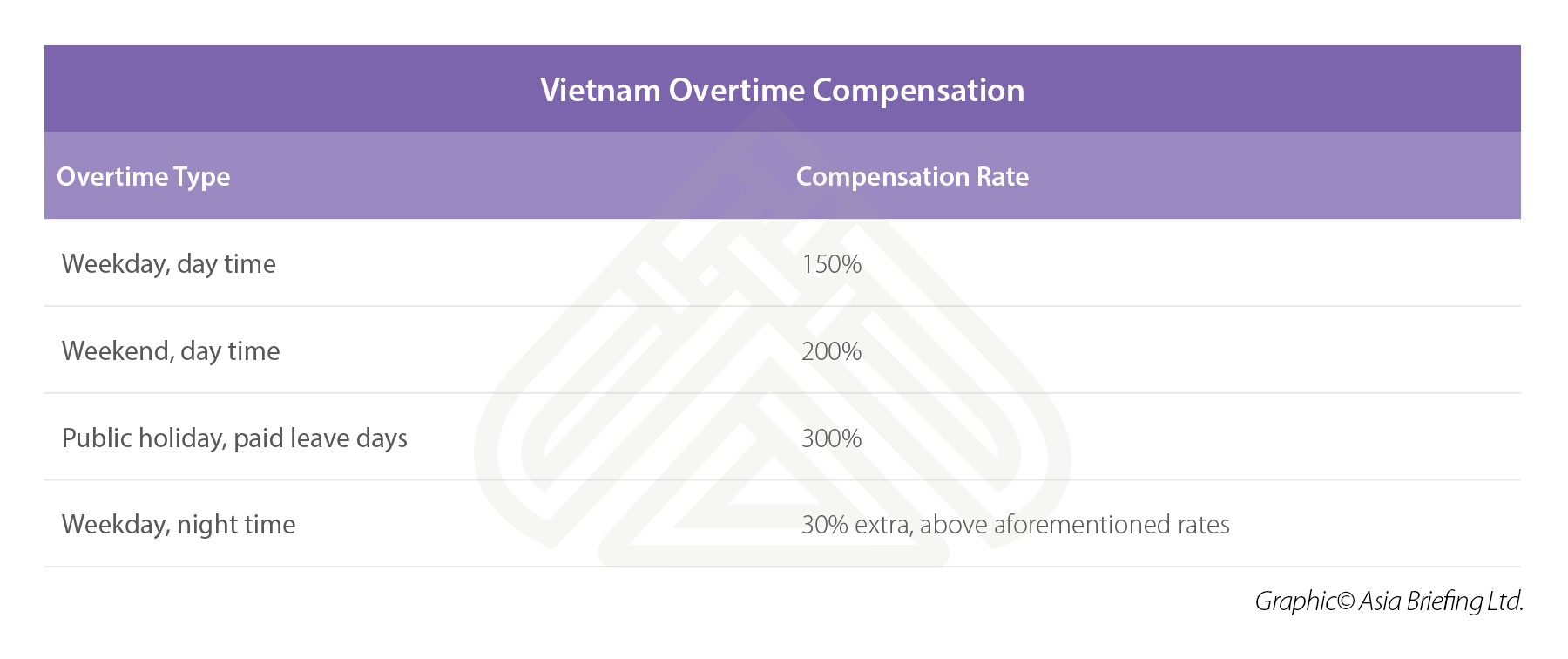

Overtime Regulations And Compensation In Vietnam

Update New York Passes Its Own Overtime Salary Threshold Increases

Your Step By Step Correct Guide To Calculating Overtime Pay

China Employment Law Update Guidance On Overtime And Working Hours Issues

6 Tips Of Overtime Calculation To Prevent Bosses Into Trouble Blog

Excel Formula Basic Overtime Calculation Formula

Defending Fsla Lawsuits For Unpaid Overtime Best Lawyers

Working Overtime In Malaysia Here S What You Should Know By Legal Street Medium